February 18th, 2026

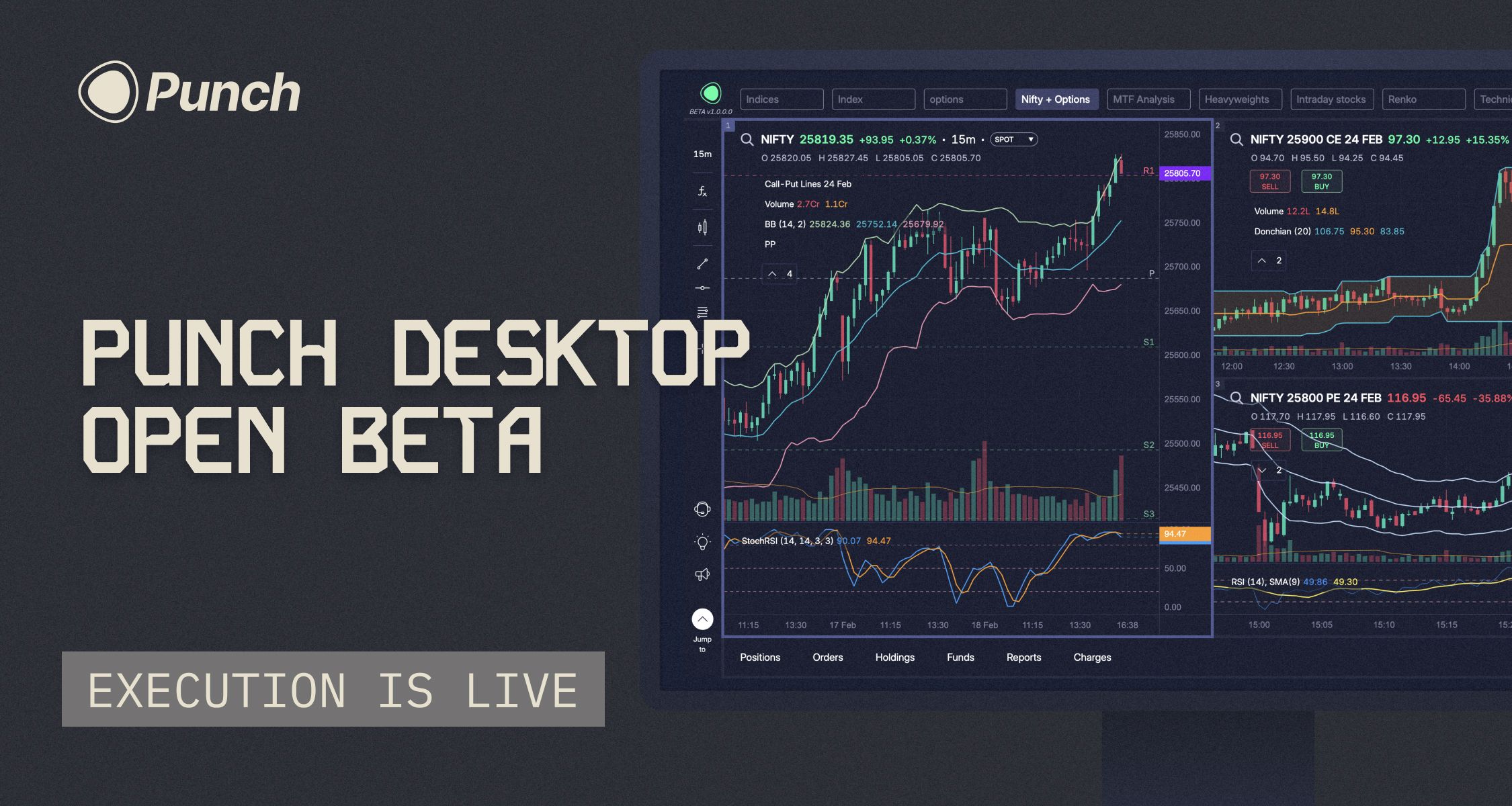

No Android update this week. This one's about desktop.

About a month ago, I opened a closed beta for Punch Desktop to a small group of users. The first version had multi-layout charting (2 to 8 charts), multi-dashboard analysis, a full indicator panel, and key drawing tools.

The feedback was clear.

Charts and analysis are useful — but desktop becomes something you actually keep open only when you can execute from it. Without execution, it's a second screen for analysis. With execution, it's a trading desk.

So that's what the team has been building over the past month.

Execution on Punch Desktop

You can now place trades directly from Punch Desktop. All core order types are live:

Market, Limit, and Trigger orders — full execution across all supported instruments.

Protection Orders — SL and TP placed alongside your entry, same as mobile.

Drag and Drop SL/TP — adjust your stoploss and target by dragging them on the chart. This was one of the most-used features on mobile, and it works the same way on desktop.

Orderbook, Positions, and Holdings — a dedicated panel with full visibility into your open orders, active positions, and holdings. Everything in one view.

Scalper Joystick Presets — if you've configured SL/TP presets on mobile, those presets now apply on desktop too. The settings themselves still need to be configured from mobile for now — that'll change once Scalper Joystick comes natively to desktop.

Option Chain on Desktop

We had three feature-priority surveys running on Builder's Lab for desktop — Option Chain, Watchlists, and Option Data.

Option Chain came in first with 177 votes. Watchlists had 148. Option Data had 121.

Builder's Lab has always been how I decide what to build next — on mobile and now on desktop. The votes made this one straightforward.

Option Chain is now live on Punch Desktop. You can view and trade from the chain, with full customization of visible columns (excluding Greeks for now).

What's Coming Next

This BETA is a drop, not the final product.

Watchlists, option data, Scalper Joystick, a full array of drawing tools, and SMC indicators — all of these are on the roadmap for desktop. Over the next few weeks, I'll be doing more drops as each of these becomes ready.

Every feature on Punch mobile will come to desktop. These beta drops help us test and re-iterate so that when we eventually do a public launch, I can deliver a complete, feature-rich product — and most importantly, one that you've built with me.

The current BETA is in the hands of select users — Champions and traders who have actively contributed to Builder's Lab. If you're interested in getting access to the next drop, comment below. I'll include you.

— Archit Sunat

February 11th, 2026

Pivot Points — Now on All Option Charts

This one has been a gap for a while.

Pivot points worked on index and equity charts. But if you opened an option strike chart — NIFTY CE, BANKNIFTY PE, any of them — no pivots.

A few weeks ago, I read this on the Builder's Lab:

"I observed Pivot Points are not plotted on option strikes in mobile as well desktop version. I am using Camarilla, Please check and update."

55 of you upvoted it. And hence I got the product team to prioritize and get it developed.

The reason this took time is that pivot point calculation depends on daily OHLC data. For indices and equities, that data is readily available. For individual option contracts, it wasn't — we had to first ensure daily OHLC was available for all options contracts before we could compute and plot pivots on them.

That's done now.

You can plot the following on any option chart:

Standard Pivots + CPR (Central Pivot Range) with key levels — Previous Day High and Previous Day Low

Fibonacci Pivots

Camarilla Pivots

All pivot methodologies are calculated from daily OHLC.

If you trade options using pivot-based strategies — whether it's Camarilla for intraday reversals or CPR for gauging range — this is an useful tool.

Custom Status Bar

Punch runs in full immersive mode on Android. This gives you the entire screen for charts and execution — no system UI eating into your space. But it also hides three things that matter during a trading session: the clock, your network status, and whether the market is open or closed.

I’ve heard about the clock one many times.

“Please add a realtime clock. This is a most important feature which is missing. In the current Punch app, we cannot see our mobile clock. TIME IS MONEY.”To test your preference, I had even run a small poll on the Builder’s Lab — Standard vs. Immersive mode. But interestingly, I got a mixed response, which led me to think that it’s not the system UI you need, but just the key information mentioned in the quote above.

So we’ve built a custom status bar that sits in the notch/cutout area of your screen — the space that was otherwise wasted.

It shows three things:

Market status — a colored indicator that tells you whether the market is open, closed, opening, or closing. During the last 5 minutes before open and before close, it shows a countdown timer so you know exactly how much time is left.

Clock — a real-time clock in HH:MM:SS format, updating every second. No more pulling down the notification shade mid-trade to check the time.

Network indicator — if your network drops or weakens, the market status is replaced with a "Weak Network" warning. This is important. When charts freeze or orders feel slow, you need to know whether it's the app or your connection.

The status bar is always on. No toggle needed. It appears on the dashboard screen and stays out of the way of your charts and touch targets.

On App Performance

Over the past couple of weeks, some of you reported app/price lags and chart loading delays. We've shipped several fixes for these already.

A couple more are on the way — specifically around issues with plotting horizontal lines via crosshair.

We'll keep at it.

That's all for this week.

— Archit Sunat

February 4th, 2026

What's new

Scalper Joystick — Now Open to Everyone

Scalper Joystick was originally planned as a Champion-only early access feature.

But the demand for this one was unlike anything we've seen before — not just on Builder's Lab, but on webinars, 1-1 calls, SMC sessions.

So we've decided to open Scalper Joystick to everyone, immediately.

This is a one-time decision, driven purely by demand.

If you missed the original release note — Scalper Joystick lets you pre-define SL/TP/Lot size, execute with a single tap (no order form), and place bracket orders by default. It sits below the chart so you retain full visibility in split view.

Advanced Option Chain — Now Live for All

Also out of early access as of today.

For those who missed it:

Toggle 15+ data points: LTP, Volume, OI, Greeks (Delta, Gamma, Theta, Vega), IV, % OI Change, OHLC

Show/Hide OI Bars

Enable % Change for intraday tracking

Candle Customization

A few weeks ago, I read this on Builder's Lab:

"Market pulse wale charts Punch par leke aao. Woh green red candle ka color better tha"

And a follow-up comment:

"Market pulse style green/red candle provide better visual clarity. Keeping the same colours in punch will really help traders."

This got me thinking about the hundreds of traders I've spoken to over the past 6 years. Charts are a visual habit. One user once told me — "ankho ko bhi aadat padh jati hai."

Punch is an execution platform, but many of you still do your analysis on TradingView or Market Pulse. You shouldn't have to re-learn your visual cues just because you switched apps.

So we've made candles fully customizable — across all chart types.

You can now set:

Body & Border colour

Up vs down colour

Setting for hollow candles

We've also added templates for TradingView and Market Pulse colour schemes. If you want your Punch charts to look exactly like them — you now can.

Indicator Source Customization

A couple of weeks ago we shipped indicator customization — colours, visibility, line thickness.

But one piece was missing: source.

For example, you can change EMA source to OHLC, HL2 or HLC3. For Bollinger Bands, you can change the MA type to EMA, SMA, WMA, DEMA, or TEMA.

Small change. More depth to your analysis.

Pre-set Watchlists

A few weeks ago I put up a poll on Builder's Lab asking which watchlists you wanted on Punch.

75 comments later, we had a laundry list.

We've started building them. For now, we've added:

NIFTY 50

NIFTY NEXT 50

F&O Stocks

These were the most requested.

Sector watchlists had big demand too — that's next. After that, we'll move to finer details. Maybe even an option to import your watchlist via CSV.

Let me know in the comments if that's a good idea.

On App Lags and Chart Loading Delays

For the past few days, some of you have reported app lags and chart loading issues.

Thanks to those of you who've shared screen recordings and detailed stories on where exactly the issue occurred. It's helping the team identify the root cause.

Identification is the hard part. Fixing is easier once we know what's broken.

We'll be releasing fixes shortly.

That's all for this week.

— Archit Sunat

January 28th, 2026

What's new

Scalper Joystick is LIVE (currently only available for Punch Champions)

A lot of you have been asking for this feature for a long time.

Not just in one place, but everywhere we show up — in the Builder’s Lab, during product webinars, on 1-1 calls with traders, and even in Yugandhar’s SMC sessions.

One of our traders pretty much summed this feature up in a post on the Builder’s Lab:

“Need direct setting of target and stoploss on chart, need a setting where we can predefine target (say 10%) and stoploss (say 2%) and each time you place order the target and SL gets placed on chart accordingly and we should be able to drag it.”

What came through very clearly was not just what was needed, but how urgently it was needed.

“It’s very necessary, most important and most powerful feature for option scalpers. Please add this immediately, very very very requested.”

“Very important and a must feature for scalping.”

Across all of them, the underlying problem was the same. Too many steps between intent and execution.

Scalper Joystick is our attempt to remove those steps.

This feature wasn’t designed in isolation. It came from reading long threads, re-reading the same requests week after week, and watching how many of you were already trying to bend Punch to fit fast, short-horizon trades.

At its core, the Scalper Joystick speaks to 4 different use cases repeatedly highlighted by our traders.

First, pre-defining the stoploss, target and lot size

With the Scalper Joystick, you can now pre-define SL/TP/Lot size settings for all your trades executed via the Scalper Joystick.

Second, entry and risk are no longer separate actions.

When you place a trade using Scalper Joystick, the entry goes in along with a pre-defined SL and target, automatically. The position is created with its exits already in place. Hence, an order executed via the Joystick is a bracket order by default.

Third, execution no longer requires an order form.

Buy, Sell, and Exit happen with a single tap. No intermediate screens. No confirmations. This applies whether you’re trading from a single chart or using split view.

This was called out repeatedly by traders, especially during volatile phases:

“One tap instant Buy/Sell/Exit instead of two or three taps. This is very crucial for trade management during volatile times.”

Fourth, you can place limit or trigger orders directly from the chart itself while using Scalper Joystick.

For now, it works for options trading only — including NIFTY, SENSEX, and BANKNIFTY — since the majority of scalping activity happens in these indices. Once the upcoming feature Protection Orders for Equity goes live, Scalper Joystick will extend to equities, stock options, and futures.

Another small but significant problem that gets solved was related to split view.

Many of you pointed out that the order form would often occlude the bottom chart while trading in split mode. This became a key inspiration for building Scalper mode as a Joystick. It sits just below the bottom chart, so you retain full visibility of both charts throughout entry and exit.

Nothing else about Punch changes when you enter this mode. You’re not moving into a different product or a restricted environment. It’s simply a different execution layer.

From a systems perspective, this required significant reworking how orders are constructed and sent. (A key reason for why it took us a bit longer to develop this feature)

One thing that is still missing — and many of you have already pointed this out — is Trailing SL inside Scalper Joystick.

We’re adding that too.

It’s currently in testing. This has taken longer than we originally expected due to a few issues we had to work through on the order-management side. I know this delay has been frustrating, and that feedback is fair. We’ll share an update as soon as it’s ready to go live.

Scalper Joystick exists because enough of you pushed for it, explained why it mattered, and didn’t let the request die out.

It’s LIVE now.

Use it, break it, and tell us what still feels off. We’ll keep iterating.

January 21st, 2026

What's new

Issue fixed

A few weeks ago, we made Drag & Drop SL/TP and new chart types (Heiken Ashi, Renko, Line & Bars) available to all users.

Since then, we’ve been able to close a large number of pending requests from the Builder’s Lab. I’ve personally been tracking the feedback coming in, and I genuinely hope you like what we’ve shipped in this release.

This week’s focus has been on SMC indicators, new drawing tools, full indicator customisation, and several small fixes that should make day-to-day trading on Punch noticeably smoother.

Let’s get into it.

Smart Money Indicators 🧠

(2nd most voted feature on Punch — 314 votes)

Fact: Drag & Drop SL remains the most voted feature with 476 votes.

Fair Value Gap (FVG)

Fair Value Gaps highlight price imbalances created by aggressive buying or selling, which often act as future areas of interest.

We now support three FVG variants, each suited to different trading workflows:

FVG Sessions

Marks the first fair value gap of each trading session, along with the session range.

This keeps the focus on the most significant daily imbalance and allows you to track how price interacts with it through the session.

Once a gap is filled, it fades visually, helping identify potential inverse reactions.

Intended for intraday charts only.

FVG Dynamic

Detects all fair value gaps and automatically removes them once price fills the midpoint or the full gap.

This keeps charts clean and focused on active, unmitigated imbalances.

FVG Fixed

Displays all detected gaps with size and duration filtering.

You can set a minimum gap size and limit how long gaps remain visible, helping filter out less meaningful imbalances.

All FVG indicators support visibility toggles and opacity controls.

Over the last few months, we’ve done multiple educational webinars with Yugandhar Sir on Smart Money Concepts, and he has played a huge role in helping thousands of traders understand these ideas.

Now, you finally have the indicators to start applying everything we’ve been learning.

(Champion access only · General access from 15th Feb)

New Drawing Tools ✏️

We’ve added new drawing tools focused on marking structure, levels, and directional bias with more control:

Vertical Line – for session boundaries and time-based references

Trendline Ray – draws a directional trendline extending forward from a single anchor point

Horizontal Ray – for projecting levels forward without extending both sides

Extended Line – for structure and trend projection beyond visible candles

These tools are designed to reduce workarounds and repeated adjustments during active analysis.

(Champion access only · General access from 15th Feb)

Indicator Customisation (For Everyone) 🧰

We’ve received a lot of requests around indicator customisation — hiding basis lines, changing thickness, adjusting colours, and more.

Every indicator now comes with a customisation panel, giving you full control over:

Visibility (show/hide plots)

Colours and opacity

Line thickness

Line styles (solid / dotted)

This applies to all indicators and is available to all users starting today.

Fixes & Improvements 🛠️

These were the three major feature updates this week. Alongside that, we’ve shipped a set of important fixes to make everyday trading simpler and more reliable.

Line Chart Improvements

Line chart colour updated to purple for better contrast across light and dark themes

Rendering behaviour standardised for improved visual stability across devices

Bug Fixes

Fixed issues with trendline and crosshair interaction

Improved decimal formatting on crosshair values for better price precision

We also received reports of trendlines shifting after placement or across sessions. This is now fixed ✅

That’s all for this week.

I truly mean it when I say “We hear you.” Every post on the Builder’s Lab is read, discussed, and reviewed by the team. Please keep the feedback coming — we’ll keep building faster and better, week after week

A Small Note from me 📔

I know many of you have been waiting for Scalper Mode. We’ve faced a few delays, but I’m confident we’ll be ready to release it by next weekend. Just a few final touches left.

Thanks for your patience — and for building Punch with us.

January 14th, 2026

What's new

Issue fixed

This week, we shipped 5 subtle but powerful improvements that make day-to-day trading on Punch faster, cleaner, and more intuitive.

🎯 Customise Your Call/Put Line Actions

You can now choose what happens when you tap on Call or Put lines.

Set it so that:

A single tap opens the order form, and

A long press opens the option chart

—or swap the two, based on how you trade.

📍 Find it here:

Index chart → Call/Put line settings → Edit (Expiry) → Scroll down to set your preference.

📈 Option Price Charts — Now 1-Tap Away

Option charts are now just 1-tap away — from wherever you are.

You can now access charts directly from:

Order Form

Orderbook

Positions

Holdings

Tap on the Chart icon (beside the scrip name) to open the respective option price chart.

➕ 1-Click Horizontal Lines

Want to mark key levels instantly?

Now, just activate the crosshair and tap the + icon to drop a horizontal line on the chart — no extra steps needed.

This is perfect for drawing zones, supports, resistances while tracking live price.

📊 Heiken Ashi Now Shows Real Candle Close Too

When using Heiken Ashi, you’ll now see:

The LTP (Live Traded Price) and

The Close of the last Heiken Ashi candle

Why this matters:

• Heiken Ashi candles are smoothed, so their OHLC differ from the actual traded OHLC.

• Showing the live traded price alongside the Heiken Ashi close helps you validate breakouts, reversals, and price action signals without losing the smoothing benefit.

🔍 Full P&L Values

You asked. We listened.

We’ve stopped rounding off P&L values like ₹2.7K.

Now you’ll see the full value, like ₹2764 — clearer, more accurate, and easier to track at a glance.

🧼 Fixes You’ll Notice

❌ Drawing tools disappearing after expiry on Spot charts — now fixed

🔐 Login friction after logout — now re-login with just biometrics, no OTP needed

🧠 Why These Matter

Each of these changes was raised on Builder’s Lab.

They might look small in isolation, but together, they dramatically improve trading speed and flow — and their impact compounds with every session.

January 6th, 2026

What's new

Your Most-Requested Features Are Now Live for All Users 🚀

Over the past 30 days, Punch Champions got early access to two of the most powerful features built with community feedback.

Starting this week, they’re now available to everyone on Punch.

🎯 Drag & Drop SL/TP – Trade Right from the Chart

You can now set and adjust Stop Loss and Target levels visually — right on the chart.

Just grab the SL or TP line and drag it to your desired price level.

✅ Perfect for fast-paced intraday/scalping

✅ Make quick adjustments based on price action

✅ Intuitive. Visual. Fast.

🧱 New Chart Types — Heiken Ashi, Renko, Line & Bar

Your chart, your rules.

Punch now supports more than just candlesticks — explore chart types that suit your trading style:

📈 Heiken Ashi – Smooths out trends for clearer direction

📊 Renko – Filters noise, highlights clean breakouts

📉 Line & Bar – For minimalist and classic traders

🔓 These features were built with Punch Builders, tested by Champions — and now, they’re yours.

Let us know what you think — we’re just getting started.

💬 Until next week

Every idea you suggest, every vote you cast, every bug you report — gets us closer to building India’s fastest, smartest trading platform.

The #onecrazymission is real. And it’s being built with you.

See you in the lab.

— Team Punch

January 2nd, 2026

What's new

We’ve taken the classic Option Chain — and levelled it up.

The all-new Advanced Option Chain gives you pro-grade control and visibility into market data. Perfect for serious traders who want more than just LTPs and OI numbers.

💡 What’s New?

🔹 Full Customization at Your Fingertips

You decide what you see. Toggle 15+ data points including:

LTP, Volume, Open Interest (OI)

Greeks: Delta, Gamma, Theta, Vega

IV, % OI Change, Open/High/Low/Close

🔹 View Enhancers for Better Decisions

Show/Hide OI Bars for quick visual cues

Enable % Change to track intraday moves faster

🔹 Built for Deeper Analysis

See the market like institutions do — filter noise, track positioning, and get a precise read on sentiment.

🎯 Currently in Early Access

The Advanced Option Chain is now exclusively available to our Champion users for the next 30 days.

🚀 Become a Punch Champion

Punch Champions makes the #onecrazymission possible.

Champions help Punch grow without ads or marketing, by inviting their friends to trade on Punch. They shape the future of trading on Punch by sharing ideas and voting on the builder’s lab.

This helps keep the brokerage at ₹1.

🏆 Benefits you get as a Champion:

30-day early access to all new features

3x voting power on Builder’s Lab polls

Free access to all paid educational webinars

🛠️ How to Join

🔁 Refer 2 trader friends and get them to trade on Punch

💡 Post a feature idea → If it gets 50+ votes, you’re in

Built by traders, for traders.

If you want early access, more influence, and free learning — step into the Champion’s circle today.

🟢 Refer now or head to Builder’s Lab to earn your spot.

December 17th, 2025

What's new

Issue fixed

🚀 New Features

Crosshair Sync in Split Chart Mode

Now view synced crosshairs across all charts — making comparison between Index, Call & Put seamless.

Charges Breakdown View

A much-requested feature is finally here — get a detailed view of all trading charges. Filter by day, week, month, or quarter to know exactly what you’re paying.

🧩 Fixes & Improvements

🛠️ Major Crosshair Improvements on Punch

Removed lag while moving the crosshair — it’s now smooth and precise

Fixed the jittery motion for better charting experience

Crosshair can now move freely beyond the last candle — no more restrictions at the edge

Volume Candle Colours Fixed (Light Mode)

Clarity restored — candles in volume chart now display correct colors.

Call/Put & Exit Button Responsiveness Improved

Reactivity issues fixed — actions now respond faster and more reliably.

App Performance Enhancements

Several under-the-hood improvements made to address app hang issues reported by a few users.

🛠️ Coming Soon

Scalper Mode (Final Testing Phase)

Work is nearly complete — awaiting final exchange approvals. Our biggest launch yet is almost here.

Feature Sprint Preview – Next Week

We’ve just wrapped up our monthly roundtable to pick what features Punch will build next. Next week’s changelog will include a full breakdown of what YOU voted for on the Builder’s Lab.

Stay tuned — big things ahead 👀

💬 Until next week

Every idea you suggest, every vote you cast, every bug you report — gets us closer to building India’s fastest, smartest trading platform.

The #onecrazymission is real. And it’s being built with you.

See you in the lab.

— Team Punch

December 10th, 2025

What's new

Issue fixed

We’re back with our release series — and this one’s stacked. The last few weeks have been massive at Punch. Here’s everything new, fixed, and upcoming.

🚀 Big Bang Releases

Trade-wise PnL

Track P&L for every entry–exit cycle — perfect for intraday and high-frequency traders.

🎖 Special thanks to Sanjiv Choudhary for seeding the idea.

Drag & Drop SL/TP

Our most requested feature ever on Builder’s Lab — set and modify SL/TP directly on the chart. No typing, just dragging. Clean, fast, precise.

Chart Types

Now plot Heiken Ashi, Renko, Line, and Bar charts.

🎖 Big shoutout to Ram Prasad Meena for pushing hard on this one.

Punch Champions Program

A new program to reward traders building Punch with us.

Champions get:

30-day early access to all new features

3x voting power on Builder’s Lab

Free access to all paid educational webinars

🧩 Fixes & Improvements

PnL Bug:

A major Trade-wise PnL issue was identified and fixed within 1 hour of being reported.

Basket Order Margin Fix:

Exit orders via basket now correctly detect as position closures — no more extra margin prompts.

Position Swatch Fix:

The option chart now reflects the correct average price and strike. Y-axis mismatch and swatch errors resolved.

Plotted Strike Lines:

Your plotted strikes are now saved even after app restart.

🔮 Coming Soon:

Scalper Mode

Our most ambitious feature yet — built for the fastest traders on Punch.

What’s inside Scalper Mode?

⚡ 1-Click Execution — skip confirmations

🧷 Bracket Orders — entry, SL & target in one tap

🎯 Default SL/TP — set once, apply automatically to every order

💬 Until next week

Every idea you suggest, every vote you cast, every bug you report — gets us closer to building India’s fastest, smartest trading platform.

The #onecrazymission is real. And it’s being built with you.

See you in the lab.

— Team Punch